In the realm of Fintech (Financial Technology), Generative AI represents an unprecedented advancement poised to revolutionize the industry's landscape. With its foundation in vast data resources, Generative AI offers an exceptional potential to enhance financial services. The incorporation of Generative AI within Fintech introduces a tailored approach to addressing customer needs and preferences.

By leveraging extensive datasets, financial institutions can offer personalized financial advice, predictive investment strategies, and customized wealth management solutions. Through Generative AI, the FinTech industry is positioned to not only optimize operations but also personalize financial experiences, reshaping how financial services are accessed, delivered, and tailored to meet individual financial goals.

As the Fintech industry continues to redefine traditional financial landscapes and adapt to the demands of a digital era, it grapples with an array of challenges, including regulatory complexities and cybersecurity concerns to the integration of legacy systems and the pivotal quest for scalability and robust infrastructure.

Challenges in the FinTech Industry:

Regulatory Compliance Issues

Navigating regulatory compliance in the FinTech sector is a multifaceted challenge. It is characterized by the intricate landscape of financial regulations. The financial industry is governed by a myriad of rules and standards, from anti-money laundering (AML) and Know Your Customer (KYC) regulations to data protection and privacy laws.

For startups and FinTech organizations, ensuring adherence to these regulations is no simple task. The complex interplay of these regulations requires constant vigilance and a proactive approach to compliance.

Customer Experience issues

One notable challenge lies in achieving seamless integration across various channels. Financial institutions often operate through multiple platforms, including mobile apps, websites, and in-person services. Ensuring that GenAI's personalized recommendations, fraud detection, and onboarding processes seamlessly integrate across these channels poses a significant technological and operational challenge. The need for a unified and cohesive customer experience requires overcoming hurdles related to data synchronization, real-time communication, and consistent AI application across diverse interfaces.

Cybersecurity

Cybersecurity stands as an ever-looming concern in the Fintech sphere. Handling sensitive financial data exposes companies to significant risks, including cyber threats, data breaches, and privacy violations. Protecting this data from sophisticated cyber-attacks demands a multi-layered security approach, encompassing robust encryption, stringent access controls, regular security audits, and employee training.

With the constantly evolving nature of cyber threats, FinTech companies are under continuous pressure to fortify their security measures to safeguard both their assets and their users' trust. Any security lapse can have severe repercussions, eroding consumer confidence and potentially leading to financial losses and legal liabilities.

These challenges underscore the intricate balance Fintech companies must strike between innovation and compliance, security, and convenience, as they endeavour to reshape financial services in today's ever-evolving technological landscape.

In the dynamic landscape of Fintech, where challenges abound, the infusion of GenAI emerges as a transformative force, ushering in a wave of innovative solutions. GenAI stands at the forefront of this financial evolution, presenting pragmatic and ingenious approaches to surmount the complexities ingrained in the Fintech sector. Its integration brings about a paradigm shift, introducing practical and effective solutions to navigate the intricate challenges unique to financial technology.

GenAI's scalability prowess and infrastructure optimization provide the essential foundation for sustained growth, empowering FinTech companies to thrive in an ever-evolving digital ecosystem.

Let's delve into the practical applications of generative AI within Fintech and identify critical areas within the industry that are ripe for transformative advancements driven by this transformative technology.

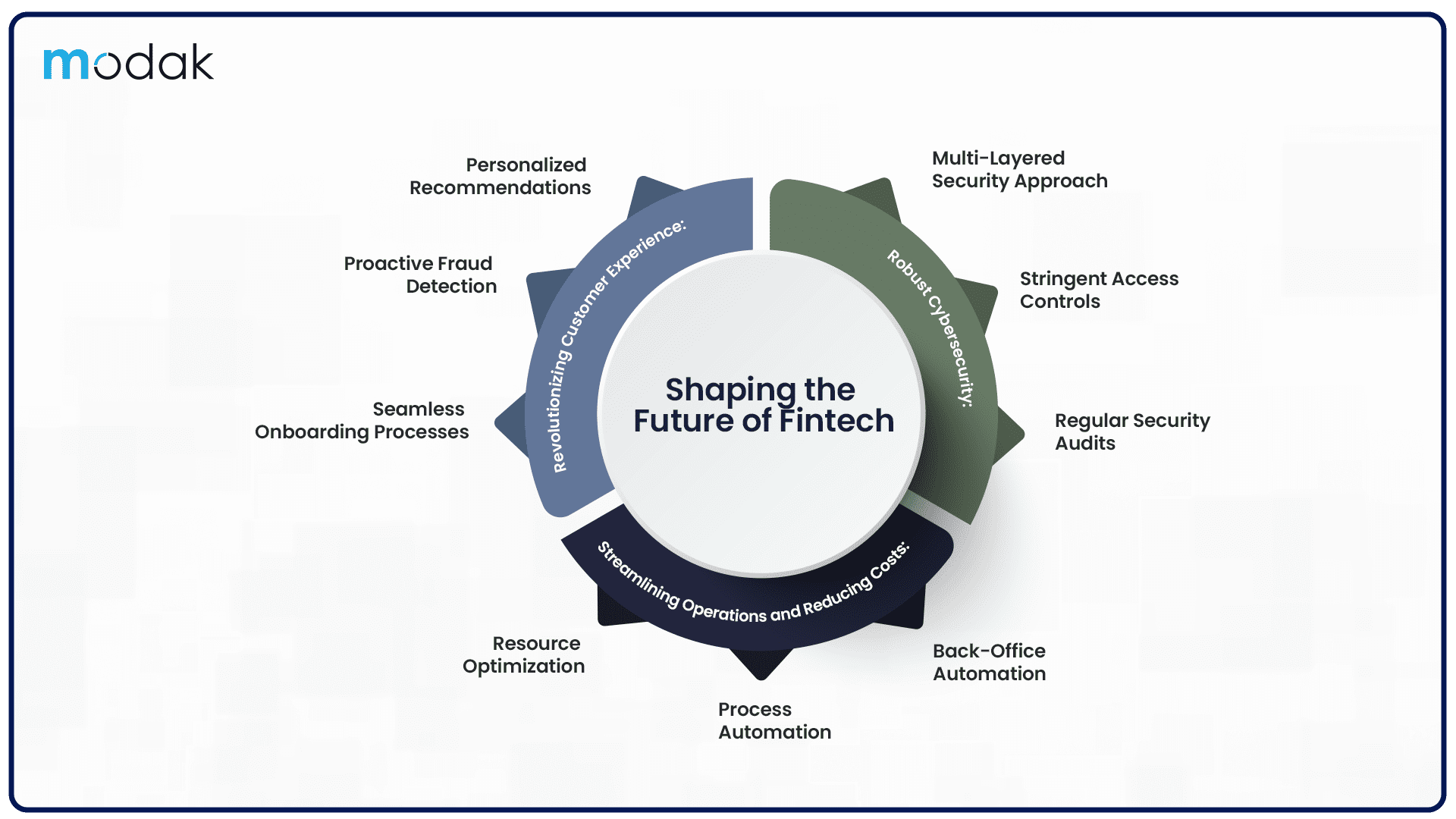

Revolutionizing Customer Experience

GenAI's AI-powered solutions are transforming the customer experience, providing personalized recommendations, proactive fraud detection, and seamless onboarding processes. By understanding customer behavior patterns and preferences, GenAI empowers financial institutions to deliver hyper-personalized financial products and services, enhancing customer satisfaction and loyalty.

Moreover, the automation facilitated by GenAI contributes to substantial cost savings. By reducing the manual workload, financial institutions can streamline the operations, save time, and allocate resources more efficiently. The financial sector's reliance on labour-intensive processes can be significantly mitigated, allowing organizations to focus on strategic initiatives, innovation, and overall business growth.

Robust Cybersecurity

GenAI's machine learning algorithms excel in detecting and predicting cyber threats by analyzing vast datasets in real time. By continuously monitoring network activities and user behaviors, GenAI can swiftly identify anomalies and potential security breaches, enabling proactive threat mitigation.

GenAI leverages dynamic encryption strategies that adapt to the evolving nature of cyber threats. It ensures that sensitive financial data remains secure against both known and emerging encryption vulnerabilities, providing an additional layer of defense against sophisticated attacks.

Streamlining Operations and Reducing Costs

GenAI's AI-driven tools are streamlining back-office operations, automating repetitive tasks, and reducing the risk of human error. By automating processes, GenAI is helping financial institutions save time, money, and resources, enabling them to focus on strategic initiatives and growth opportunities.

The automation facilitated by GenAI contributes to substantial cost savings. By reducing the manual workload, financial institutions can streamline their operations, save time, and allocate resources more efficiently. The financial sector's reliance on labour-intensive processes can be significantly mitigated, allowing organizations to focus on strategic initiatives, innovation, and overall business growth.

GenAI stands as the vanguard of change in the dynamic landscape of financial technology. Its integration within the fintech sector marks a transformative leap, ushering in a new era of personalized, efficient, and secure financial services. Through its innovative AI-powered solutions, GenAI has redefined the customer experience, streamlined operations, bolstered risk management, and unlocked unprecedented growth opportunities for financial institutions. GenAI has emerged as the mainstay of fintech innovation, transforming risk management, automating back-office processes, and providing highly tailored financial advice.

About Modak

Modak is a solutions company dedicated to empowering enterprises in effectively managing and harnessing their data landscape. They offer a technology, cloud, and vendor-agnostic approach to customer datafication initiatives. Leveraging machine learning (ML) techniques, Modak revolutionizes the way both structured and unstructured data are processed, utilized, and shared.

Modak has led multiple customers in reducing their time to value by 5x through Modak’s unique combination of data accelerators, deep data engineering expertise, and delivery methodology to enable multi-year digital transformation. To learn more visit or follow us on LinkedIn and Twitter.